This Chart Should Scare You; is the mortgage market in for a 2008 wreck; average down not even close to 20%

Article Originally posted on Fairview Lending

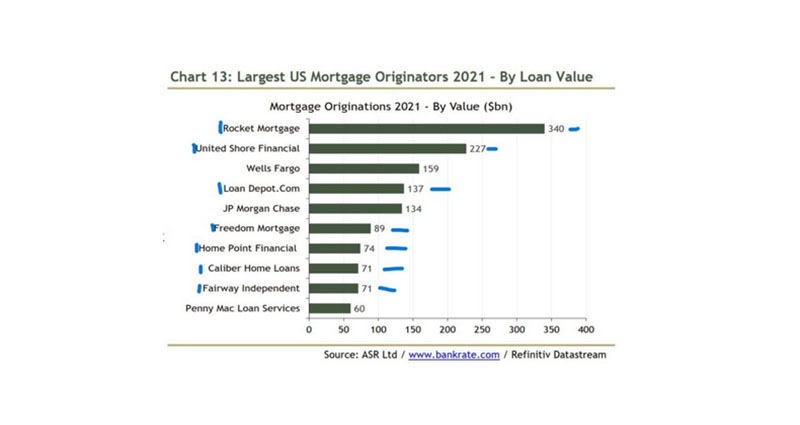

The federal government in their quest to shore up the mortgage market in 2008 has created some new risks to the housing market. Non bank lenders now make up 74% of the origination volume with only 3 banks even making the list. What does this mean for the mortgage market and in turn the housing market? Why are non bank lenders now making up such a large share of originations? Do we have another large scale “wreck” coming our way?

Why are non bank lenders gobbling market share from traditional banks?

Before talking about why banks are gaining market share, it is important to discuss Dodd Frank. The response to the 2008 mortgage crisis was the creation of increased regulation in banks to prevent future crashes. What was in Dodd Frank?

Dodd Frank is a series of measures that first required banks to have … READ MORE ...